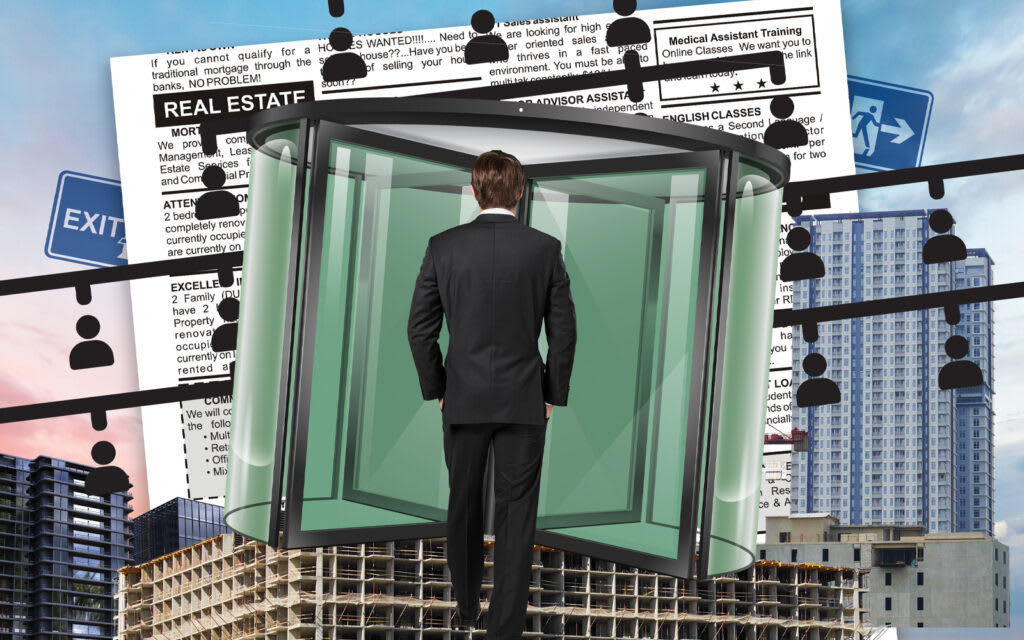

Trinity Place Holdings’ condo at 77 Greenwich Street is a revolving door of sales teams.

Since sales launched in 2019, the developer has tapped four sets of brokers to take the reins, with news of the latest shakeup announced just last month. Five years in, only 40 of the tower’s 90 units have sold.

Brokers say shuffling in more than three teams is unusual, but the Financial District condo is following in what developers and brokers describe as a New York City tradition: switching representation when the going gets tough.

“Every day that you’re on the market and not selling is costing you more,” said Shlomi Reuveni, the most recent broker to take over sales at the building. “Lenders are in the background knocking on your door. You’ve got to make changes.”

Developers are under significant pressure to deliver milestones, from proving their project’s viability to meeting loan deadlines. When sales stall, many hope onboarding a new set of brokers can keep lenders and other project stakeholders at bay.

These swaps tend to ramp up in times of market upheaval, especially in downturns.

As the Federal Reserve began hiking interest rates, developers traded one team for another: 1228 Madison Avenue replaced Corcoran Sunshine with Compass’ St. André Team, while the developers at 100 Vandam and 219 Hudson Street added Serhant in place of Douglas Elliman.

Now, with mortgage rates expected to drop, developers expect deals at buildings with low sales volume to start moving again.

If sales don’t pick up, “[developers] are going to get frustrated their project is not moving at the same velocity as others,” said Bianca D’Alessio, the managing director of Nest Seekers’ new development marketing arm. “I do think we’ll start seeing more of those takeovers.”

Why developers switch — and to whom

Swapping out sales teams is typically part of the life cycle of a new development. These projects are long hauls, and the initial brokers are often brought on in the early days of the process — usually years ahead of any units hitting the market.

Once it’s time for sales, “that team is already pretty stale,” said developer Robert Levine.

Which team is tapped next depends largely on existing relationships and recommendations from other stakeholders, though sometimes developers will look to the brokers bringing the most buyers to their buildings.

“When you’re the second or third agent on the project, that’s a good thing because the developer’s more realistic. They know what the product is and how buyers are reacting to the pricing,” said Serhant agent Marzena Wawrzaszek. “When there’s a fourth or fifth team that’s coming on the project, that means something’s not right.”

Take 77 Greenwich. Trinity ousted its initial broker team, The Marketing Directors, after two years and replaced them with agents from Serhant.

Under new leadership, the building rebranded to the Jolie, but the new moniker didn’t last for long.

The next broker was Shaun Osher’s Core Real Estate, which replaced Serhant in August — with about 40 percent sold at the time — and shifted the marketing back to its address.

Just six months later, the developer swapped Core for Shlomi Reuveni, of Reuveni Development Marketing and Christie’s International Real Estate Group — a transition that coincided with the launch of a selection of units on the building’s upper floors.

“Every day that you’re on the market and not selling is costing you more.”

Reuveni declined to comment on where previous brokerage teams had gone wrong but said new development sales are only as successful as the on-site agents and the brokerage’s management strategy.

“This market is not about TikTok selling. It’s not about social media. I don’t believe in that. It really is about brokerage, understanding the deal,” Reuveni said. “If the management is not there, no amount of TikTok is going to sell your project.”

Snappy new names, revamped photos and a headline or two often mark the transition to a new sales team, but what the fresh faces bring to a project is more ambiguous and differs from building to building.

“There is no one formula for every project,” Reuveni said.

Brokers often point to the intangibles — energy, enthusiasm and a fresh perspective — as the advantages of a new team. But neighborhood expertise, buyer profile or marketing strategy are also value adds for developers looking to make a switch.

At Quay Tower in Brooklyn, RAL Companies ousted Elliman for Ryan Serhant’s eponymous firm, a move Levine, the company’s founder and CEO, credited to Serhant’s digital marketing expertise and in-house media studio.

“When the market’s good, everybody’s wonderful. When the market has any ripples in it or tension, you start to see the failings of a system,” Levine said, adding that the previous team had “started to show real cracks.”

But switching sales teams too many times can be disruptive and alienate buyers, according to Levine. It also signals troubled waters, as frequent turnover is a sign that the developer is ignoring brokers’ recommendations, particularly on pricing.

“Getting rid of the sales team is low-hanging fruit for a developer to blame somebody,” Levine said.

Brokers who join projects near their start have to prove their value for a long time, starting before their real work of trading units begins.

“New development marketing firms are usually involved in the development from the beginning and supply just as much thought leadership, content and crafting of the message as anyone else,” said Andrew Wachtfogel, co-founder and new development president at Official. “For whatever reason, the sales team is looked at as something that can be switched out.”

State of play

Corcoran ruled new development in 2023 with a total sales volume of close to $12 billion, according to The Real Deal’s analysis of closed sell-side transactions in 2023. The firm led sales at some of the city’s top-selling buildings, including Tribeca Green, One High Line and 450 Washington.

Elliman logged the second-highest new development sales volume with roughly $7 billion in closed sales last year. Compass, which heads sales at some of Miki Naftali’s condo projects on the Upper East Side, ended 2023 with just under $4 billion in sales.

Closed sales offer some insight into which firms dominate the new development space, tracking who was the busiest moving deals in a given year.

But the complete picture of a brokerage’s footprint in the market is more complex: It takes in closed sales, contracts signed, the number of buildings the firm represents, the number of units and the dollars those units represent to show how firms stack up against each other.

The city’s landscape for new development marketing is also shifting, as the project pipeline shrinks and larger brokerages focus on buildings with higher projected sellouts and a large number of units to move.

“When things are tight, the big players are reluctant to take on smaller projects where there’s more risk,” said Kael Goodman, founder and CEO of Marketproof.

Less to fight over

Rising mortgage rates and economic uncertainty roiled New York City’s new development last year.

Contract signings for condos dropped 8 percent from 2022, according to Marketproof data. New development sales volume reached $7.2 billion, down 10 percent from 2022.

In Manhattan, deals fell 12 percent year-over-year, compared to Brooklyn’s 9 percent dip. Queens was an outlier with contracts increasing from 408 to 447, thanks to rising demand for new developments in Long Island City.

Inventory shrank citywide from 12,700 units in 2022 to 10,200 in 2023.

Despite the drop, demand for new development in the city was up 6 percent from its pre-pandemic average. And the market is showing signs of improvement — new development deal volume in February rose 21 percent month-over-month and 12 percent annually.

The city’s pipeline of projects is drying up, spelling fierce competition for limited listings.

“The new dev sector’s certainly going to have a nice war, isn’t it?” Douglas Elliman’s Frances Katzen said.

You can read the article on The Real Deal here.